Plan B

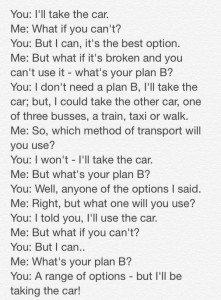

First of all, the reason why there’s no Plan B in the White Paper and why Alex Salmond didn’t want to reveal a Plan B in the TV debate is because the three principles of getting the best deal, providing maximum clarity and refusing pre-negotiation are in direct conflict:

- If we want to get the best deal for Scotland and provide maximum clarity to the voters, we’ll have to pre-negotiate important questions such as which currency to use.

- If we want to provide maximum clarity and accept the veto on pre-negotiations, we’ll have to give away out negotiation strategy and accept the risk that we might not get the best deal for Scotland.

- If we want to get the best deal for Scotland and accept London’s veto on pre-negotiations, we have to be cagey about our negotiation strategy, thereby sacrificing a certain amount of clarity.

Given this trilemma, it’s understandable the Scottish Government has chosen the third option. They can’t force London to pre-negotiate anything, even if it would clearly be best for the voters, and of course they can’t accept not getting the best deal for Scotland.

Basically, Salmond should have told Darling the following: “Of course I have a Plan B in my drawer. And a Plan C. And a Plan D. I wouldn’t be doing my job if I didn’t. However, if I revealed my alternative plans, I would effectively reveal my negotiation strategy, and that would inevitably lead to a worse deal for Scotland. I want the best deal for Scotland, so I can’t do that. Do you not want Scotland to get the best possible deal, Alastair?”

On top of this, there are extremely good reasons for believing that Plan B will never be needed because Plan A (a formal currency union) is actually in Westminster’s own interest:

[The Westminster politicians are] shooting themselves in the foot if they [veto Plan A], because there’s good reason to believe that a formal currency union will benefit the rUK more than Scotland because it’s good for currencies to be anchored in natural resources (such as oil) and exports (such as whisky) rather than being dependent mainly on volatile financial services.

Westminster vetoed a currency union to achieve a No vote, not because it’s in the rUK’s political and economic interest (which it isn’t):

It seems George Osborne was thinking that if he ruled out a currency union, voters would naturally vote No to independence. I’m not sure it has occurred to him that we might vote Yes in spite of his speech (or even because of it). […] By ignoring [other] options and by failing to explain why rUK politicians would opt for a solution that might harm rUK businesses, he shows that his sole purpose is scaremongering. He didn’t make this speech to provide visibility for rUK businesses (which would have been prudent), but to bully Scottish voters into voting No.

Even if Plan A really was vetoed by the rUK, Scotland would definitely be using the pound anyway:

Using the pound informally would be possible, but it’s an option that is normally used by rather small countries, and I can’t see it being a sensible long-term option for Scotland (although it might be a good idea for a transitional period) […]

[A] Scottish currency linked to the pound sterling isn’t scary at all. In fact, that’s exactly what’s already happening at the moment when the Bank of Scotland, the Royal Bank of Scotland and Clydesdale Bank issue their own banknotes. They basically have to store one pound from the Bank of England every time they issue one pound, and that’s exactly how a currency board (which is the technical name for a linked currency) would work.

To put it simply, the National Bank of Scotland will put one pound sterling into its vaults (or more likely, into an electronic account) for each Scottish pound it issues. In that way, a Scottish pound is exactly as safe as an rUK pound because the National Bank of Scotland has the means to replace the one with the other if needed.

Furthermore, if a currency union isn’t agreed on, Scotland will receive a lot of assets to implement one of the solutions above:

Let’s have a wee look at the BoE’s Annual Report from 2013. On page 99 it states that the total assets are worth £58,022m (58 billion pounds), and the bank has put exactly the same amount into circulation as banknotes. This means that Scotland’s 8.3% population share last year was worth £4816m. […]

The amounts mentioned above don’t include the UK’s currency reserves (PDF), which belong to the Treasury (although they’re administered by the BoE). In August 2013 the gross currency reserves (including gold and all that) were worth $103,418m, and the net reserves had a value of $44,862m. I’m not an economist, but I presume it’s the latter that are of interest to us here. Scotland would in other words be due currency reserves (including gold) worth $3724m (or roughly £2232m).

Of course, it would hardly be great news for the stability of the Pound Sterling to lose such a great parts of the assets underpinning it from one day to the next, which is why it’s very likely the rUK politicians will start begging Scotland to accept a formal currency union soon after a Yes vote.

Finally, joining the Euro isn’t a possibility at the moment (even if we wanted to), and there’s a simple way to stay out of it so long as we want:

[The] main issues are likely to be the national debt (unless the rUK decide to keep all of it in order to safeguard their permanent membership of the UN’s Security Council) and the need to have been a member of ERM-II for at least two years. It seems unlikely Scotland would be able to introduce the euro before 2023, even if it became a political priority.

Of course, if Scotland decides not to introduce the euro, staying out of ERM-II is all it takes. This is what Sweden and many of the newer EU members are doing at the moment.

It’s therefore understandable why Salmond didn’t want to talk about a plan B, and it’s also clear that an independent Scotland will be using the Pound for the foreseeable future.

Can we now talk about something which actually matters to most voters?

Plan B http://t.co/umI5M6e62N

RT @arcofprosperity: New blog post: Plan B http://t.co/ppg4WCbHap #indyref #ScotDecides

Jennifer Baird liked this on Facebook.

RT @Sign4Scotland: Plan B http://t.co/umI5M6e62N

RT @arcofprosperity: New blog post: Plan B http://t.co/ppg4WCbHap #indyref #ScotDecides

RT @teechur: “Plan B” – A coherent and straightforward explanation of the currency question. Somebody show Ali D, please. #indyref http://t…

RT @teechur: “Plan B” – A coherent and straightforward explanation of the currency question. Somebody show Ali D, please. #indyref http://t…

RT @teechur: “Plan B” – A coherent and straightforward explanation of the currency question. Somebody show Ali D, please. #indyref http://t…

RT @teechur: “Plan B” – A coherent and straightforward explanation of the currency question. Somebody show Ali D, please. #indyref http://t…

Good stuff – apart from the negotiations-related bit. It’s because the various plan B’s have real drawbacks that the SNP wont draw attention to them, not that picking one would somehow prejudice negotiations.

I don’t agree that it’s only because of various flaws with the different alternatives that Salmond won’t discuss them, but it’s obviously an element, too. Every potential course of action has its own pros and cons, and it doesn’t make any sense to try to defend them all at the same time — it’s enough to defend one.

Anyway, what do you think Salmond should have said to Darling during the debate?

“Anyway, what do you think Salmond should have said to Darling during the debate?”

Beats me! The currency issue is simply a cast-iron vote-loser that the No camp will keep battering away at. Not sure if there’s a ‘solution’ as such.

Don’t you think my suggestion would have worked? If Darling had persevered, it would have looked as if he was trying to sell Scotland down the drain.

RT @teechur: “Plan B” – A coherent and straightforward explanation of the currency question. Somebody show Ali D, please. #indyref http://t…

RT @teechur: “Plan B” – A coherent and straightforward explanation of the currency question. Somebody show Ali D, please. #indyref http://t…